Navigating the Multifamily Rental Market in 2024

A Landlord’s Guide to the Softening Market as Indicated by 2023 Reports and Surveys

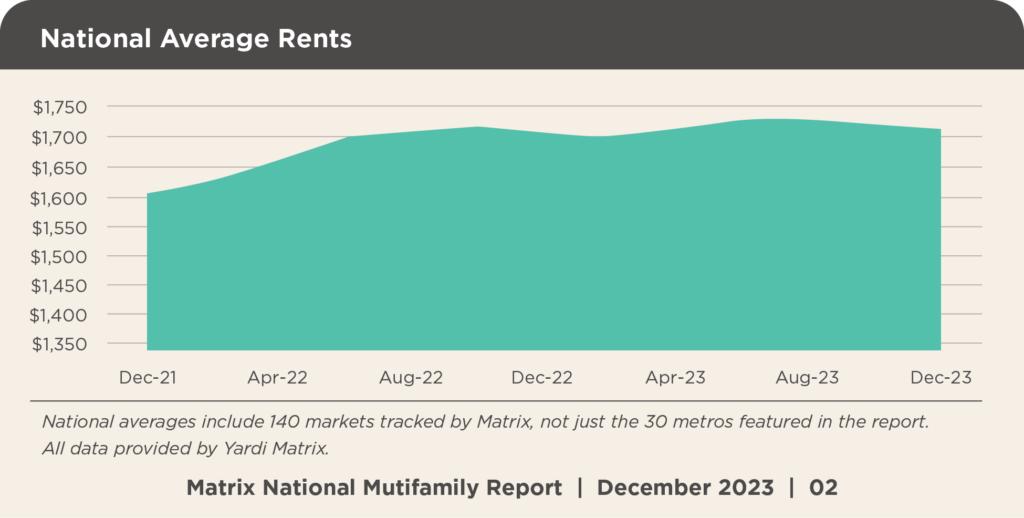

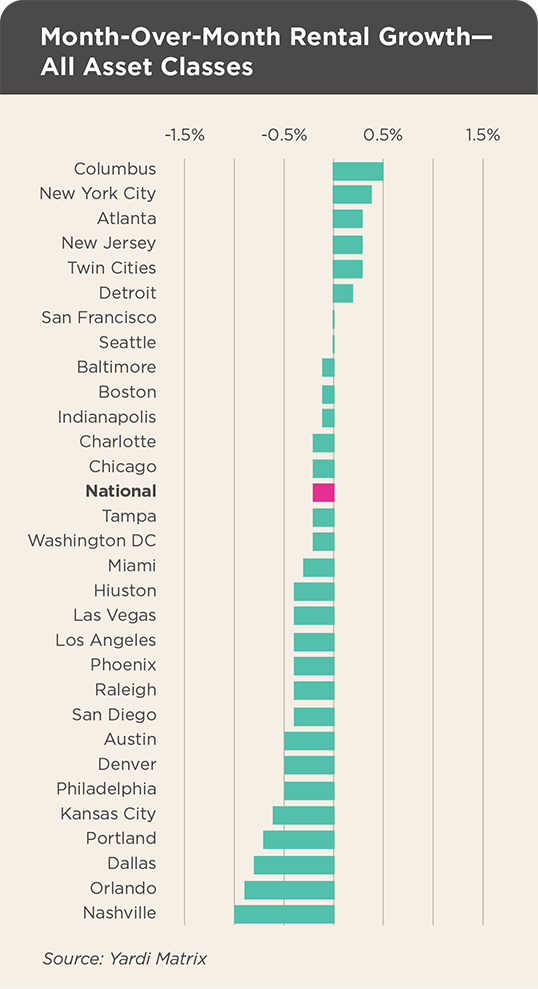

In December, the average U.S. multifamily asking rent decreased by $4, or 0.2%, to $1709 (Zillow). In a softening market, competitive pricing is key. Landlords should conduct thorough market research to understand current rental trends and adjust their pricing strategies accordingly. This doesn’t always mean lowering prices; sometimes, it’s about aligning your offerings with market expectations. Utilize tools and platforms that provide real-time rental data to make informed decisions.

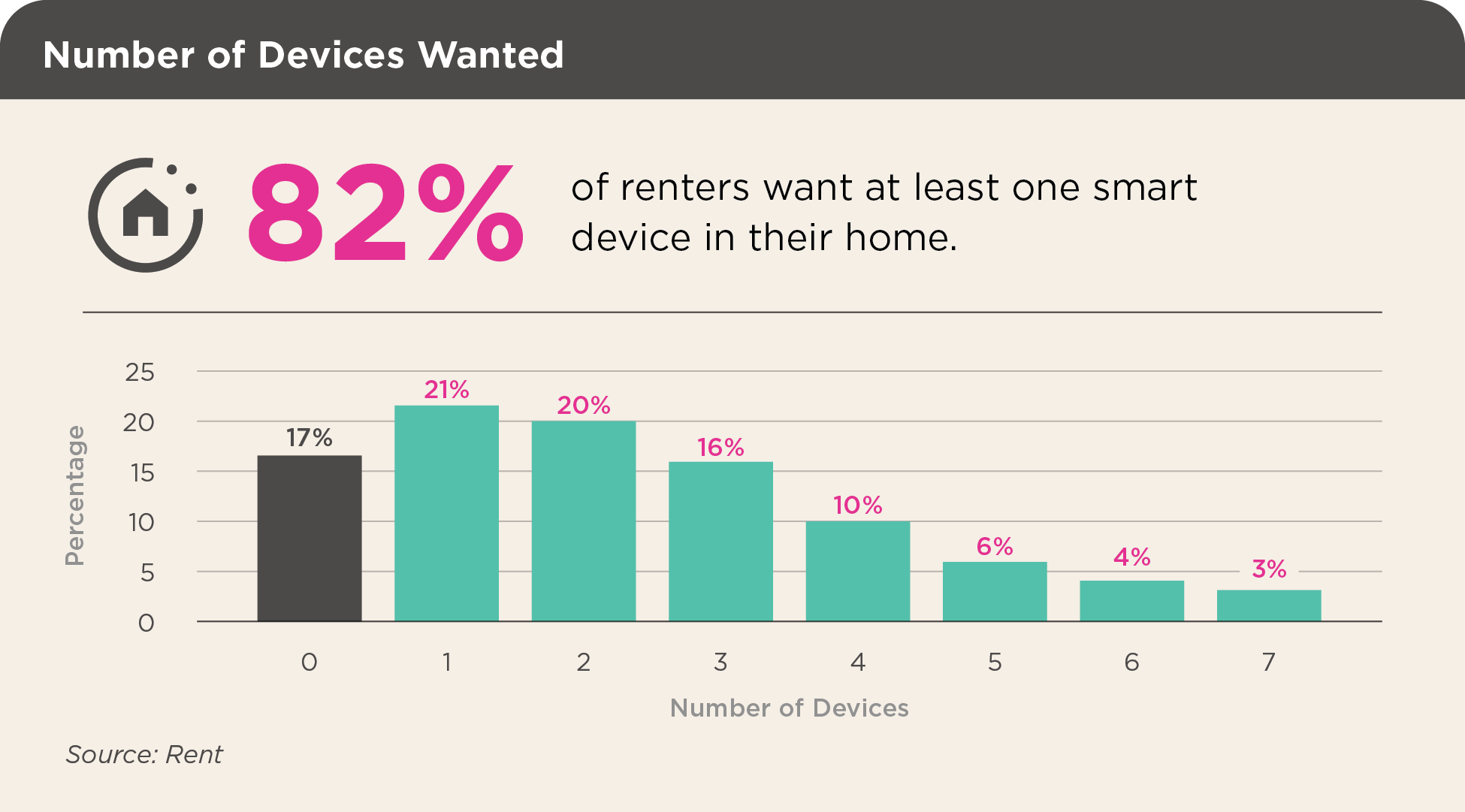

The national average cost of a turnover is equal to three months’ rent not including the lost rent during the vacancy (Visio). Strategies such as offering renewal incentives, maintaining open and transparent communication, and promptly addressing maintenance issues can enhance tenant satisfaction and reduce turnover rates. Minor property upgrades don’t have to be expensive and are highly valued by tenants. Installing smart home solutions like smart locks, lighting systems, and storage lockers not only impacts satisfaction, but can increase your rental price without upsetting most tenants. According to this survey from 2022, 82% of all tenants wanted at least one smart home technology upgrade. And tenants paying between $501 and $2000 per month were willing to pay an additional $40-$50 a month just to have this amenity added. Consider implementing your own surveys or less formal check-ins to gauge the desires your tenants might have.

With modern property management platforms, you can find automated solutions to many aspects of the business. These automations increase tenant satisfaction by streamlining communication and payments, and ensuring document retention. A poll from January of 2023 showed half of the surveyed tenants stated digital rental payment options were important to them.

For filling vacant properties, platforms that facilitate secure self-guided tours increase property traffic by 40%, reduce vacancy periods, and almost double conversion rates to 9.3% compared to traditional showings at 5%. While harder to calculate, there’s a lot of value in reducing the amount of personal time and energy required to manage your properties. Time is money, after all. Fun fact – Ben Franklin actually coined that term in a 1748 essay.

Expenses such as labor, maintenance and insurance jumped sharply for multifamily owners in 2022 and 2023. Not looking great for 2024. Some categories of growth will subside as inflationary pressures abate, but other categories may not. For example, insurance premiums will likely keep increasing, as insurers must cover for the growing number of weather-related payouts. Tightening your operational budget can help offset revenue fluctuations. Review your current expenses and identify areas for cost savings, such as renegotiating service contracts, Insurance rates, investing in energy-efficient upgrades, or adopting preventive maintenance to avoid costly repairs. Every dollar saved on expenses directly improves your property’s profitability.

The key indicator of the rental market’s health and competitiveness is the rental vacancy rate, and it is slowly increasing. In a competitive market, differentiating your property can help attract and retain tenants. Small upgrades or improvements, such as fresh paint, updated fixtures, or landscaped exteriors, can significantly enhance a property’s appeal. Consider amenities or features that add value to tenants, such as high-speed internet access, in-unit laundry, or secure parking. With an expected 500,000 additional multifamily units hit the U.S. market this year, everything from a new coat of paint to the aforementioned digital and Smart Home solutions could be dealbreaking.

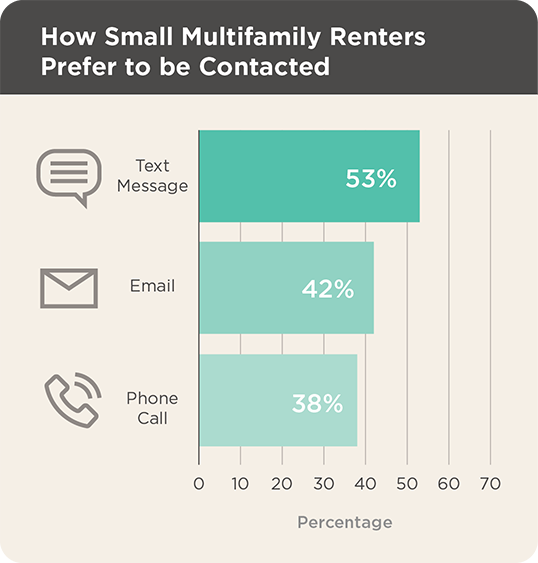

A strong online presence significantly increases your property’s visibility. Level up your communication based on the tenants’ preferences. Utilize social media platforms and rental listing websites to showcase your property through high-quality photos, self-guided tours with “See it Now!” call to action and engaging descriptions.Targeted online advertising can also reach potential tenants actively searching for rentals in your area.

Citations

Bachaud, N. (2023, December 8). A blend of stability and gradual changes in the U.S. rental market (November 2023 Rental Market Report) – Zillow Research. Zillow. https://www.zillow.com/research/november-2023-rent-report-33470/

Lapin, H. (2023, June 1). Landlord’s Guide To Keeping Quality Tenants | Visio Lending. Visio. https://www.visiolending.com/blog/tenant-retention

Maher, L. (2024, February). How to set a fair price for your rental property. https://instashowplus.com/how-to-set-a-fair-price-for-your-rental-property/

Rent. (2023, June 26). Smart home technology that renters want in 2022. Rent. Research. https://www.rent.com/research/smart-home-technology-for-renters-survey/

Triplett, J. (2023, August 16). What attracts renters to smaller multifamily properties? Rental Housing Journal. https://rentalhousingjournal.com/what-attracts-renters-to-smaller-multifamily-properties/

Yardi Matrix. (February, 2024). Matrix Multifamily National Report-January 2024. https://www.yardimatrix.com/publications/download/file/5071-MatrixMultifamilyNationalReport-January2024